Posted on

January 17, 2023

by

Sam Chaim

It’s a new year so with this first newsletter let me once again wish you only good things in the coming year for you and your family. 2022 was a successful year due to the tremendous support extended by you, my clients, and friends. I am most grateful as once again I reached the Remax Platinum award level, top 2% in North America.

We’ve all been touched and even paused by world & economic events of the past year, yet it’s a time to look ahead. A refreshed calendar presents a new year filled with new possibilities and opportunities.

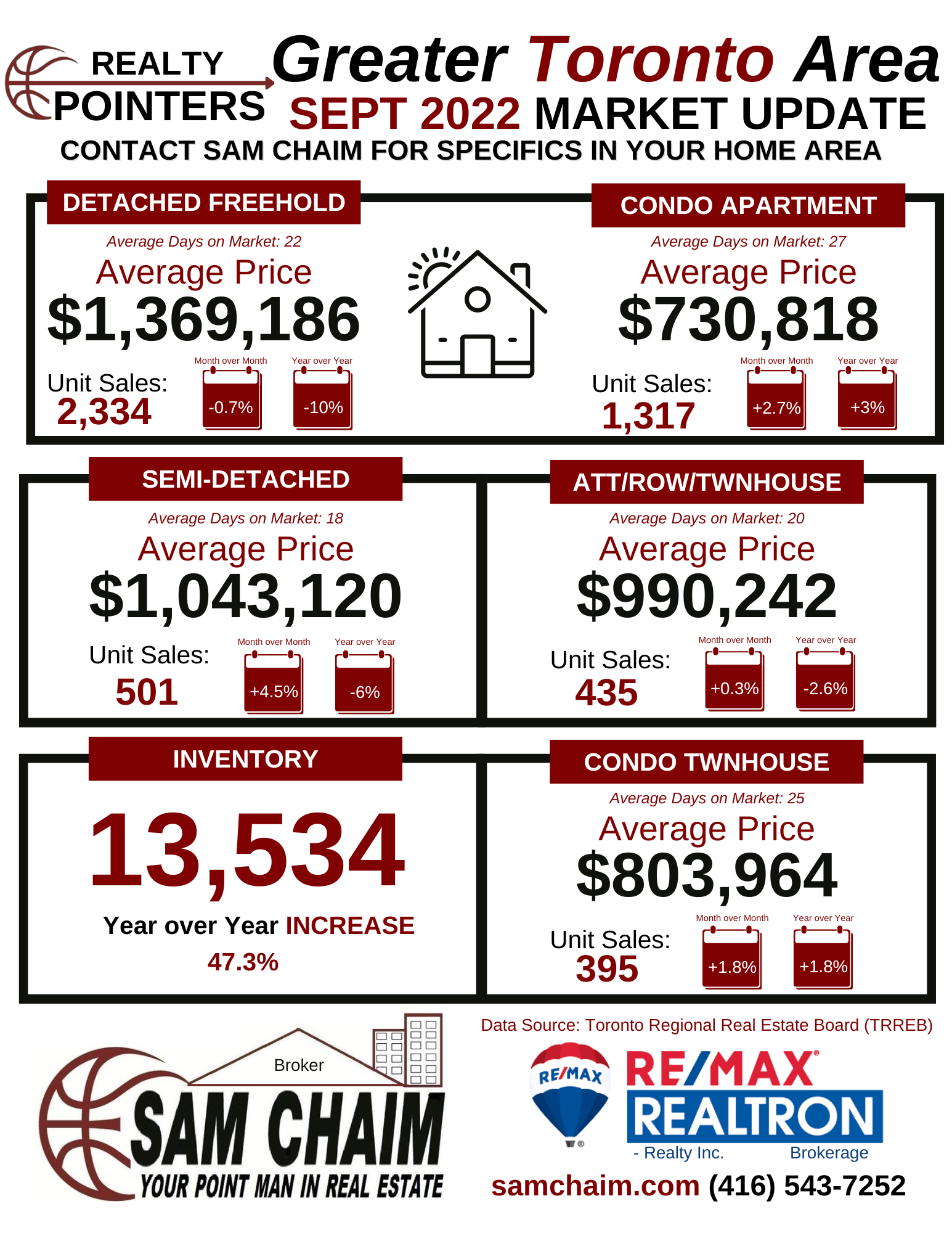

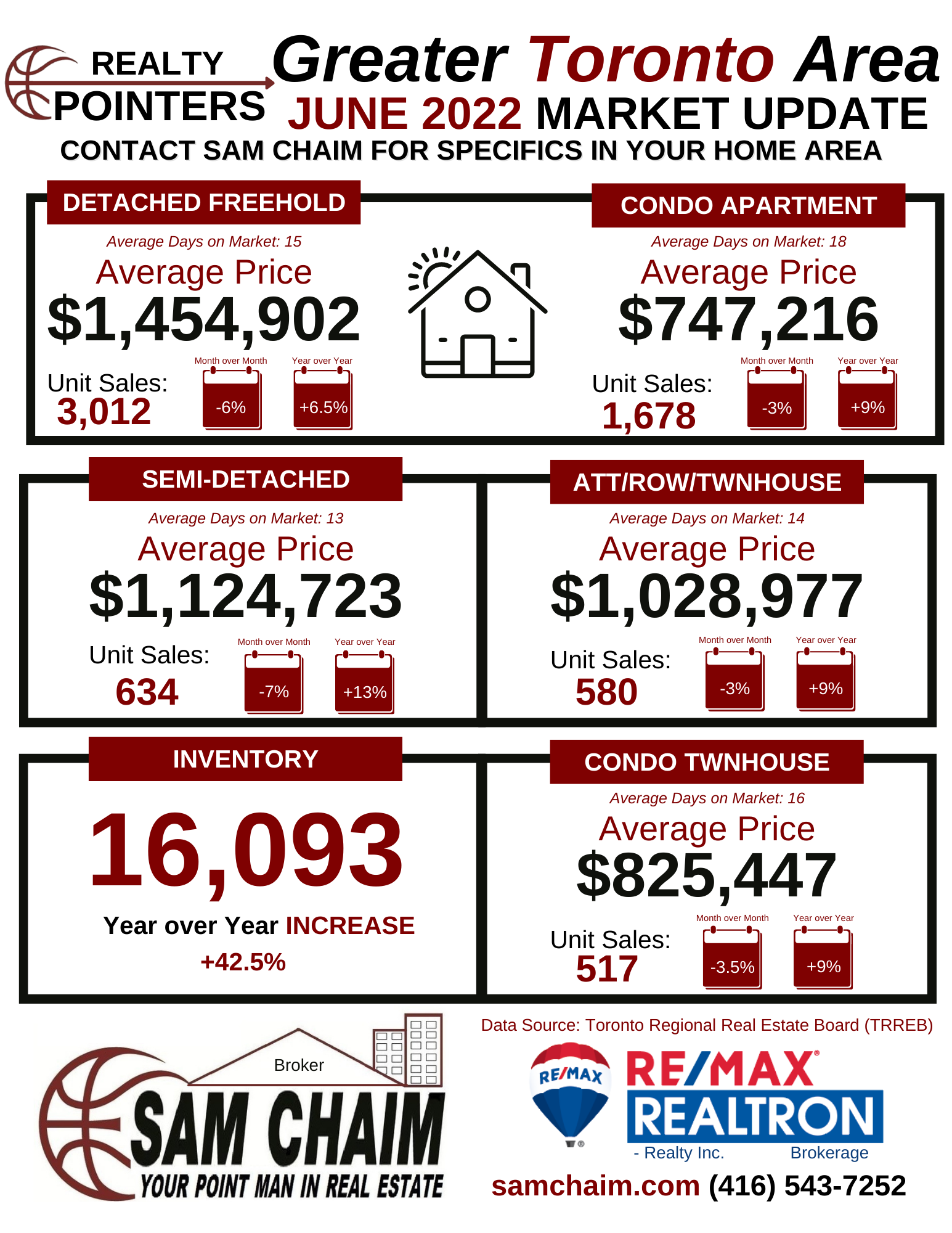

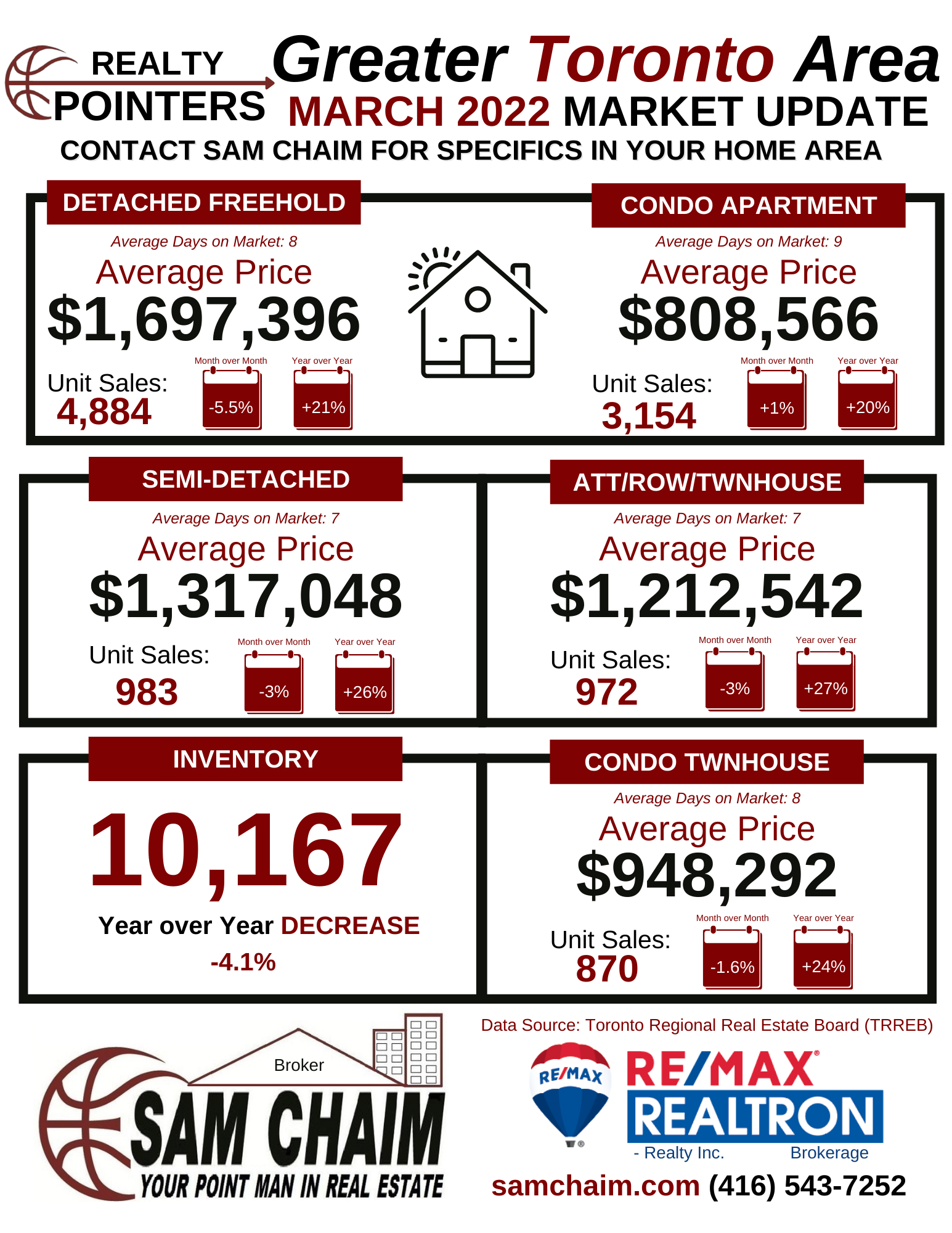

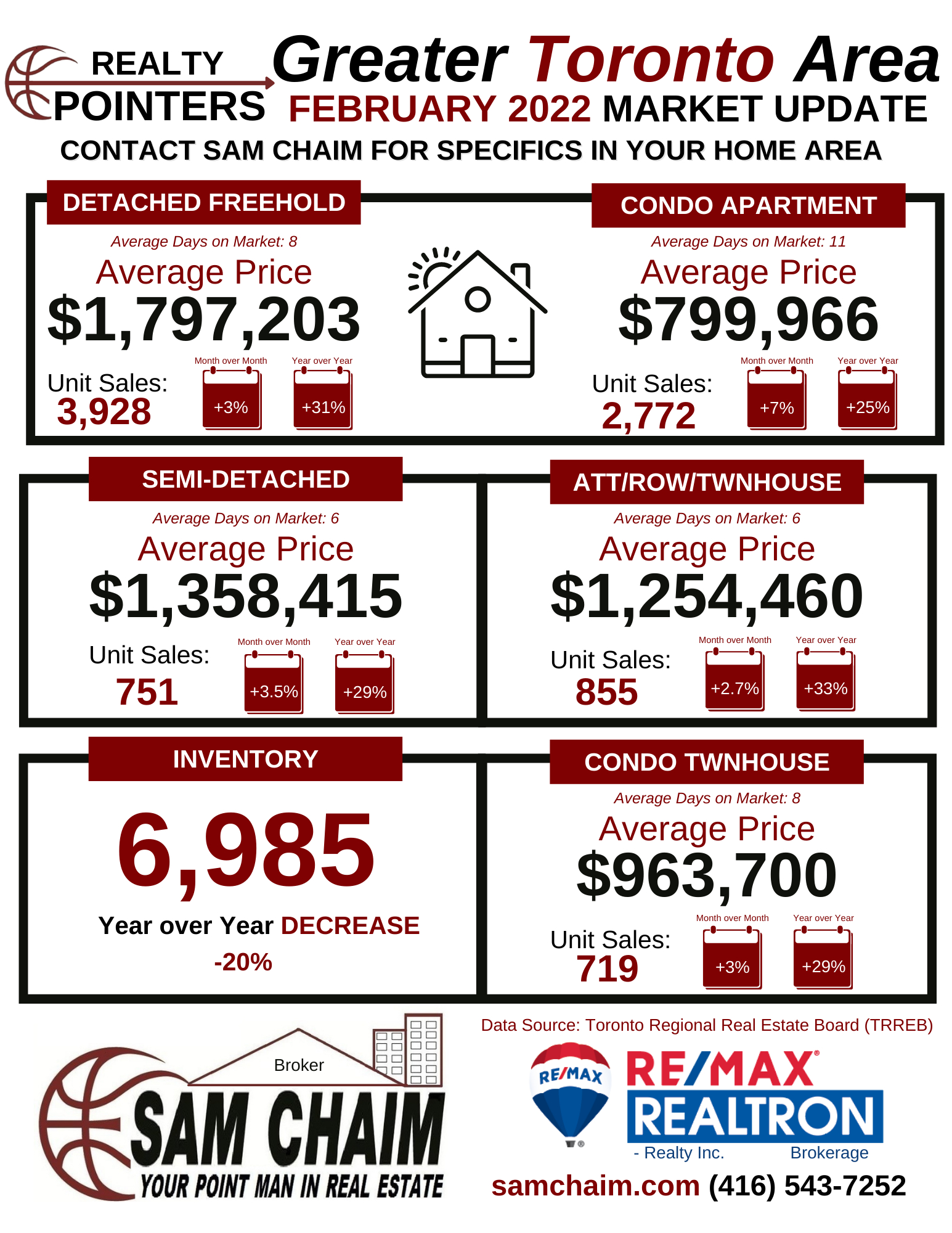

There are also new challenges in 2023. December’s sales of 3,117 brought 2022 to a close with a total of 75,140 homes sold at an average price of $1,189,850. This compares to 2021’s average price of $1,095,333. While the average price is up from a year ago, it does not tell the whole story. In fact, prices have been adjusting downward since they rose by 25%-28% in last year’s February/March timeframe.

Looking forward, two major factors should be considered and understood:

1- as we entered 2022, a buying frenzy occurred. Buyers were convinced prices would continue to skyrocket and decided to get into the market regardless of price and so prices rose an unsustainable +25%.

2- the Bank of Canada is singularly focussed on squashing inflation by dramatically raising interest rates. This has eliminated many buyers from qualifying for financing but at the same time created uncertainty and a fear of what is to come. Some Buyers and Sellers have decided to sit back and see how the market responds, impacting both demand and price growth.

At the risk of repeating myself it needs to be said, that the reality of the market in Toronto is created by the housing shortage that won’t be alleviated in the short term, (our listing inventory is only at 8,692,), and rents have increased by 12%-15% while renters are now more consistently facing bidding wars. With an estimated 1.2 million new LEGAL immigrants (plus others seeking asylum) poised to come to Canada in the next 3 years, it doesn’t take a market expert to understand what will happen to home prices in the GTA. Also to be considered is the psychological impact the uncertainty brings as the financing challenge is understandably worrisome for most.

Over the last 15 years we have had ultra-low interest rates. We have either forgotten, or new buyers are unaware, that those rates are truly remarkable. In the 1970’s, mortgage rates fluctuated between 8%-12% and people bought! In the 1980’s they were between 14%-23% and yes, people financed even at 23%. I was one of those in 1981 at 18.75%! Between 1990 - 2008 interest rates were between 8%-14% and people still bought! Point being, it takes time for buyers to adjust to a new reality and those who do will be smiling down the road, just as I did.

I can’t speak to what might happen in other parts of Canada, but I don’t share the negative outlook for Toronto. I believe buyers will soon adjust to the new mortgage rates as they have adjusted to the increases in home prices over the past years. Great opportunities exist in the real estate market right now. The fortunate ones are those who need little or no financing. For them, this is a definite time to buy with the lower prices being the bonus. Even if we are not sure we have hit the bottom of this cycle, in my opinion, yes, I am going out on a limb, we are close.

Whether to upgrade your existing home, right size your lifestyle or buy an investment property, now is a great time to jump in while others are on the sidelines.

As we begin this new year, I look forward to connecting with you and invite your calls whenever you’d like to know “what are they asking?” or “how much did it sell for?” or "my friend is thinking of a move. Can you help them?". Let's connect and set you on the right path.

Best wishes for a great 2023 and….

To A Good Life!

Sam Chaim - Your Point Man in Real Estate

Making A Difference For You

Re/Max Realtron

(416) 543-7252

sam@samchaim.com

Watch Video

Read Full Market Stats Package