Posted on

June 10, 2025

by

Sam Chaim

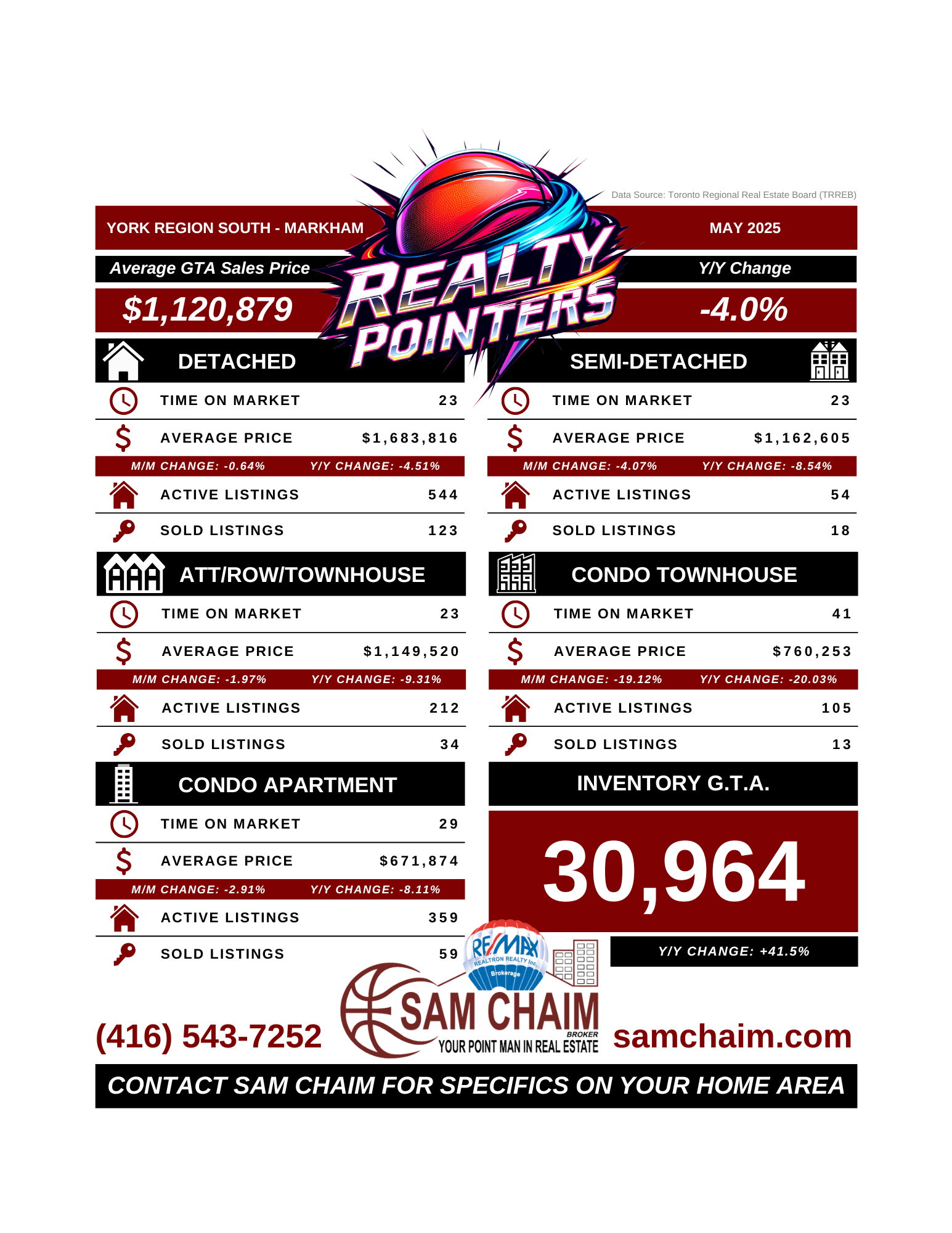

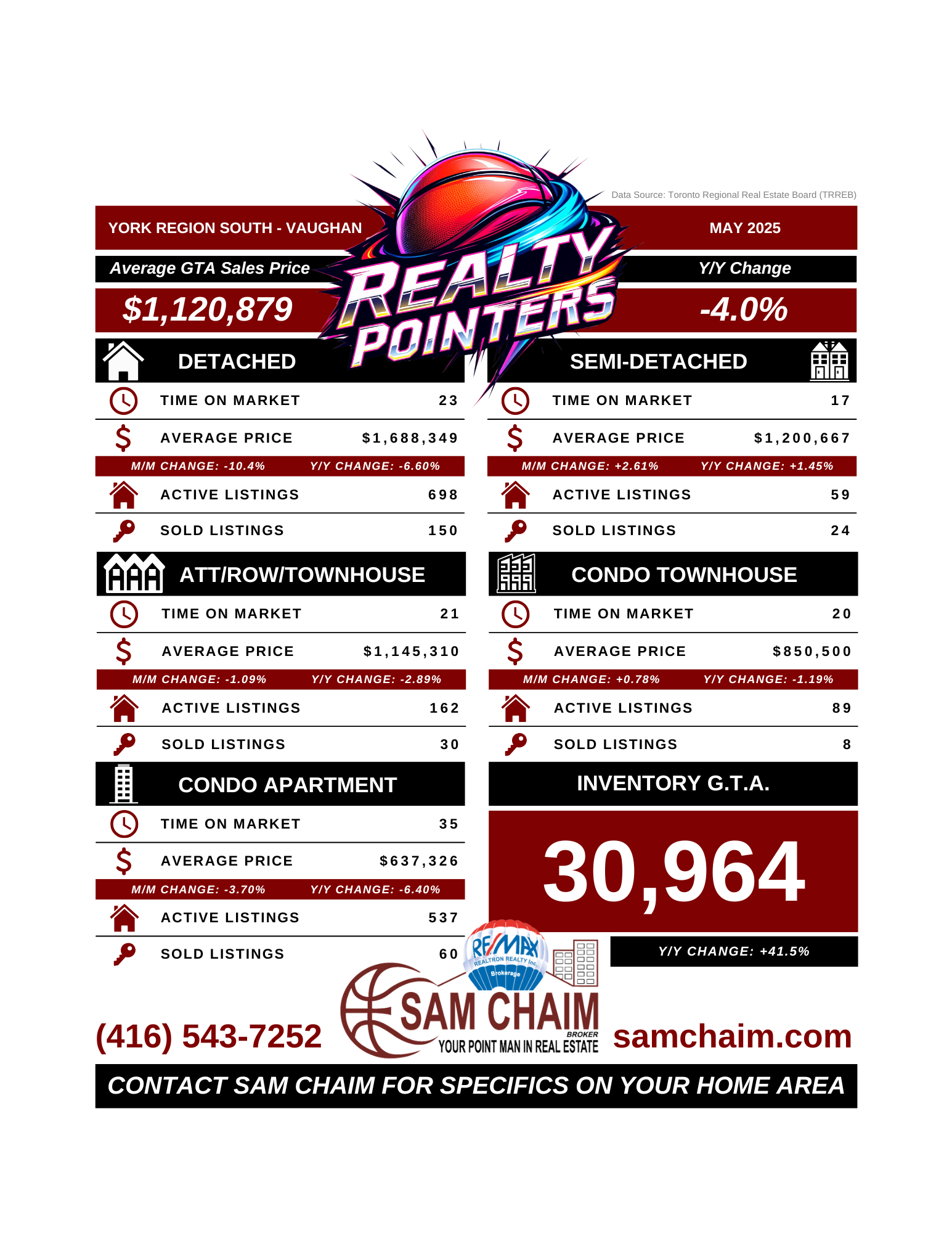

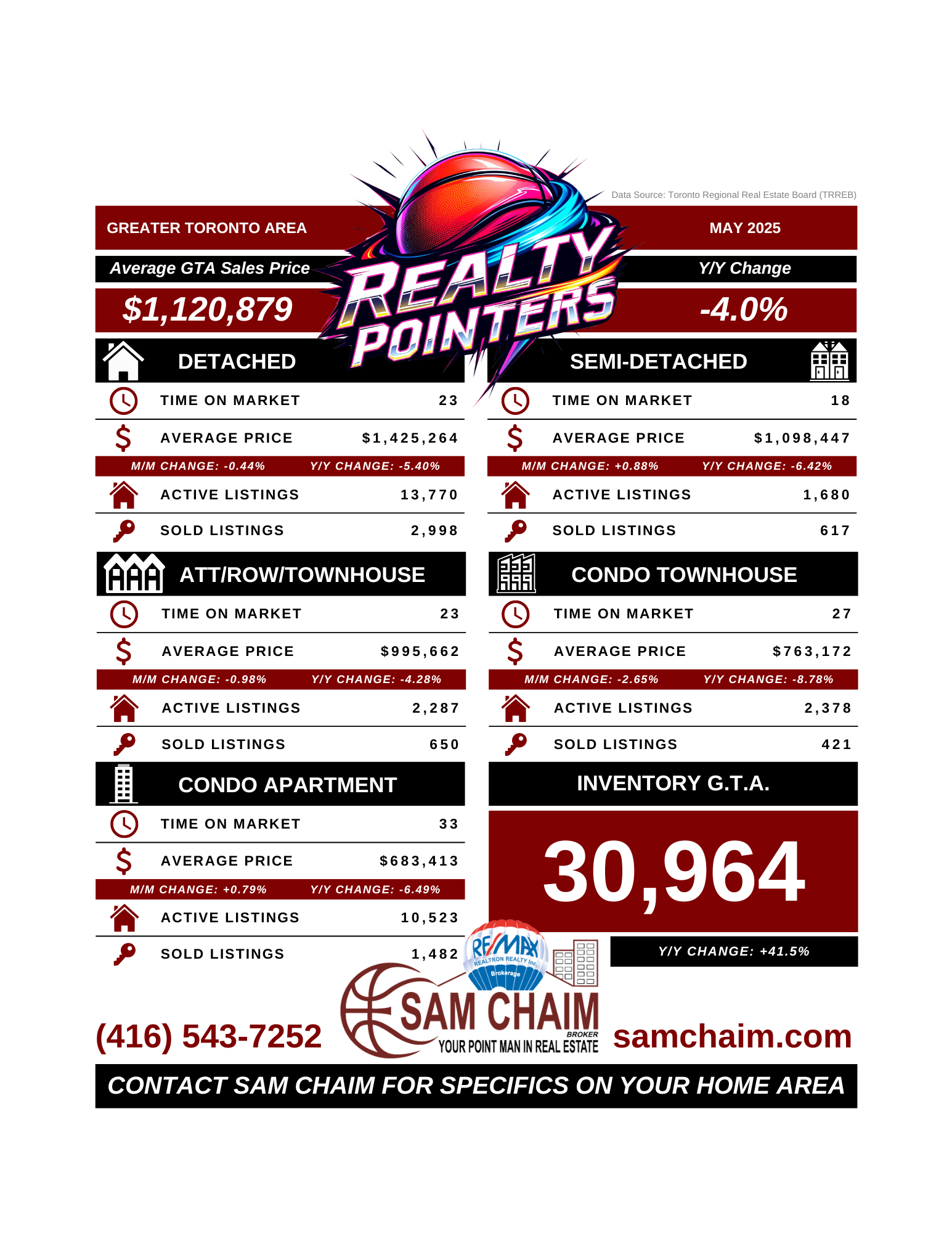

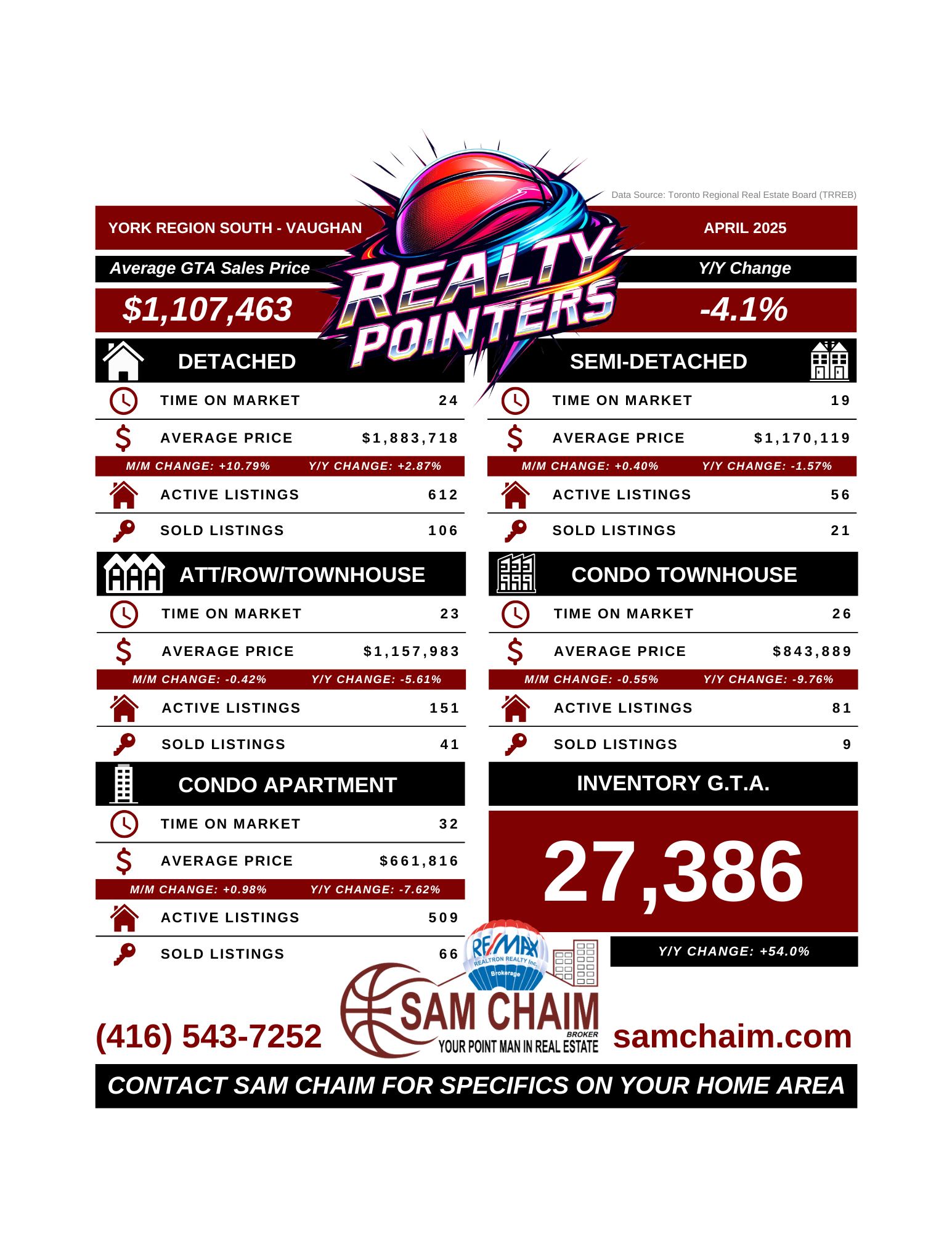

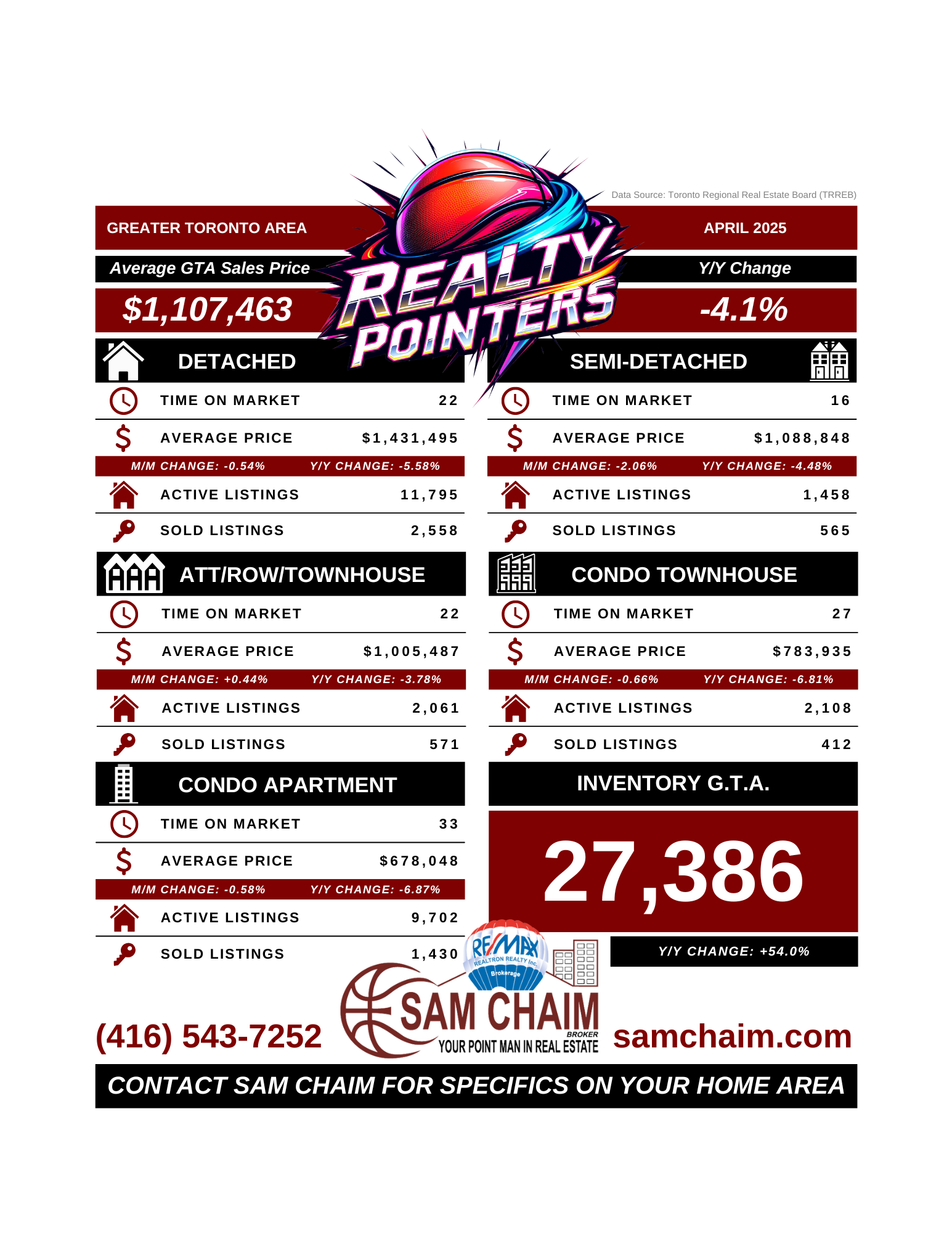

The Toronto housing market showed signs of improved affordability in May 2025, creating a unique window of opportunity for both sellers and buyers.

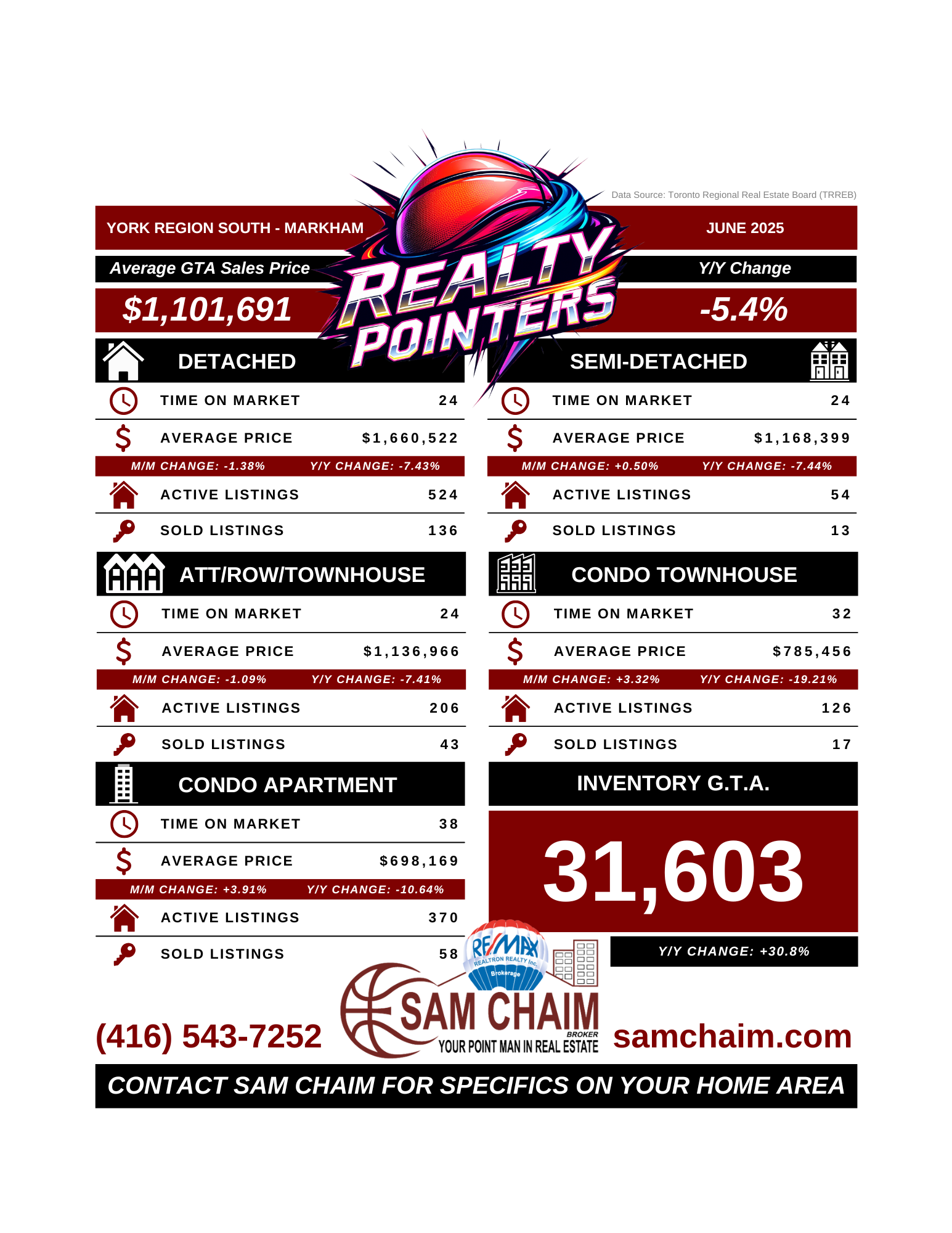

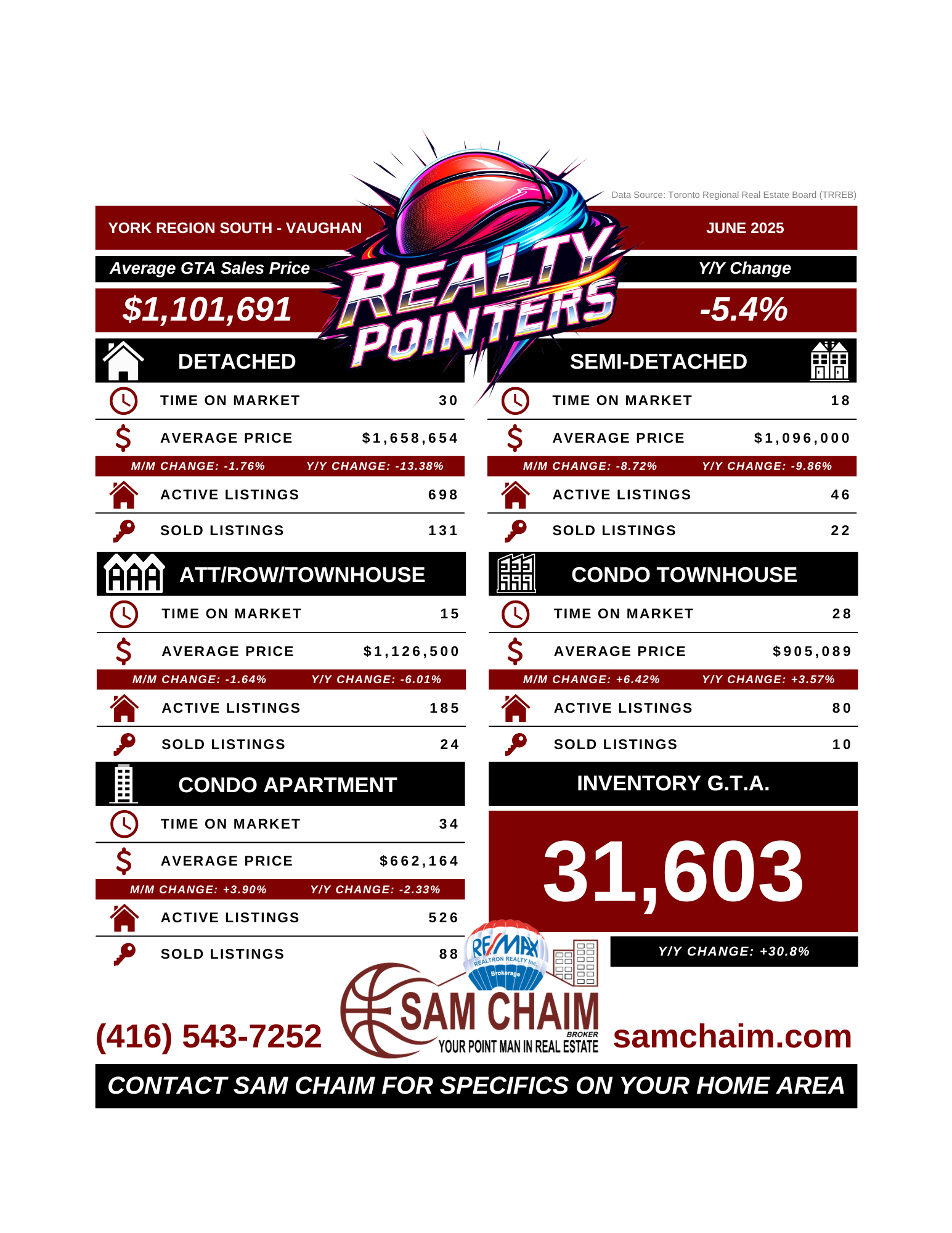

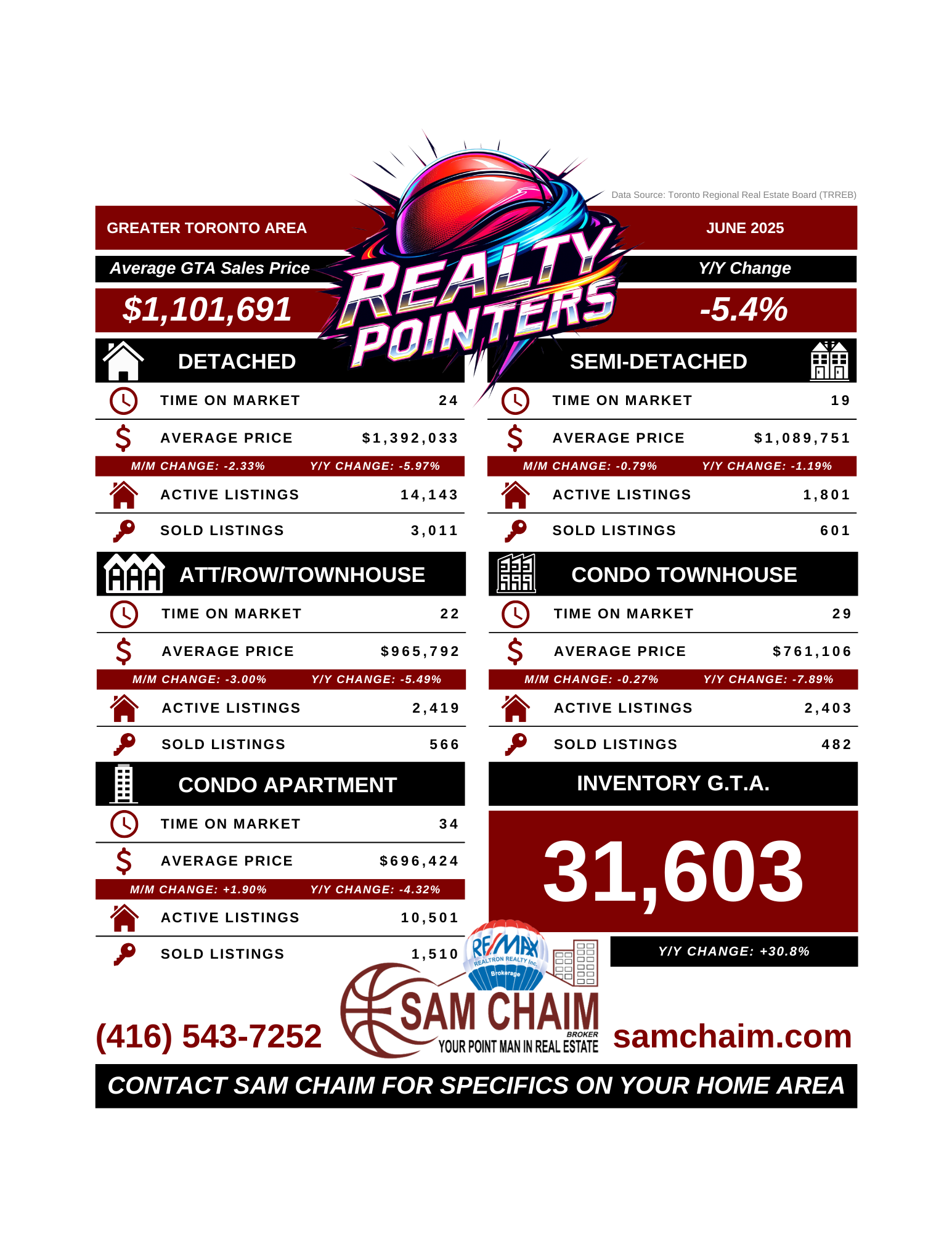

According to the Toronto Regional Real Estate Board (TRREB), home sales across the GTA fell 13.3% year-over-year, while new listings rose 14%, giving buyers more negotiating power and greater selection. However, on a seasonally adjusted basis, sales actually increased month-over-month for the second time in a row.

For Sellers

With more listings on the market, it’s crucial to stand out. Pricing strategically and marketing effectively can help you attract serious buyers who are still actively looking. Now is the time to position your home correctly and take advantage of renewed buyer momentum.

For Buyers and Investors

Improved affordability—thanks to lower average selling prices ($1,120,879, down 4% YoY) and reduced borrowing costs—means you may find better value and negotiation leverage. Inventory is up, and many buyers are using this market to make smart, long-term investments.

Bottom Line

The GTA market is evolving, and timing your move is key. Whether you’re selling, buying, or investing, every neighbourhood has its own story—and I’m here to help you understand it.

Contact me today to plan your next move with confidence.

To A Good Life,

Sam

Read Full Report